Finance & Banking Chatbot: Benefits, Use-Cases & Examples

The Rise of Conversational Banking

Conversational banking is the technology that allows banks (and fintech companies) to talk to millions of customers across multiple touchpoints. It uses AI driven banking chatbot which can automate eKYC, smart notifications, user onboarding and customer support.

Often part of an omnichannel communication strategy, it allows banks (and fintech companies) to engage their customers where they are actually active: WhatsApp & Web. This is especially impressive when one considers how cost-effective conversational banking is. Accenture research shows that 57% of companies agree that chatbots (like banking bots) can pull in large returns on investment (ROI) with minimal effort.

What Are Banking Chatbots?

A banking chatbot is a simple widget that the financial institutions can add to their websites (or web-apps) to dramatically improve their customer experience.

They do so by simulating human conversations, based on pre-defined conversational flows that you are free to determine according to your specific use-case.

Does Banking Industry Need Banking Chatbots?

Yes they do! If you think about it, chatbots in banking are part of a natural progression from the era of human bank tellers to ATMs to digital banking. But the million-dollar chatbot question is ‘Why’?

There are two primary reasons why your average customer will always prefer an engaging conversation to a long, dull form ⤵️

What Is A WhatsApp Banking Chatbot?

A WhatsApp Banking Chatbot is a conversational banking solution that automates end-to-end engagement across all customer touchpoints — from eKYC to customer support.

They do so by simulating human conversations based on a predefined set of conditions, that you are free to determine according to your specific use-case.

What is WhatsApp Marketing Software?

In the public imagination, WhatsApp is viewed (rightfully so) as the most popular instant messaging service in the world. With more than two billion active users — if WhatsApp was a country, it would technically be the most populous one.

But what is often overlooked in the public discourse is the incredible technical infrastructure that WhatsApp provides for businesses, to enhance and upgrade their ⤵️

🎯 Lead Engagement: Pre-sale; includes lead generation and lead conversion

🎯 Customer Engagement: Post-sale; includes transactional messages, customer marketing and customer support.

The technology that enables the automation of this lead cycle is called a WhatsApp Marketing Software. Example? The Tars WhatsApp Engagement Suite.

Benefits Of WhatsApp in Banking

Since WhatsApp is primarily perceived as an instant messaging app to communicate with friends and family, WhatsApp Marketing Software (like the Tars WhatsApp Engagement Suite) allows banks & financial service companies to position themselves as much more approachable, trustworthy and personal in all its customer interactions.

Moreover WhatsApp Messages have an open rate of nearly 98% and a response rate of nearly 40%! By giving 5x times more visibility and responses than any other channel, WhatsApp blows every other lead & customer engagement channel out of the water.

Benefits of Web Banking Chatbots

Chatbots in banking and financial services have already achieved the kind of mainstream success that other marketing/cs automation tools often aspire to. In more ways than one, banking bots today are quickly taking over the teller or the relationship manager’s place as a customer’s first and primary interaction point with a bank.

With that said, here’s a deep dive into the various benefits of chatbots in banking & financial services:

✅ Lower onboarding time, more eKYC submissions.

✅ Cost savings & lower turnaround time (TAT)

✅ Improved Customer Satisfaction (CSAT)

✅ Personalized Customer Experience (CX)

✅ Fraud reduction

✅ Better time management

WhatsApp Use-Cases For Banks & Financial Services

1. Conversational eKYC

A financial institution must confirm that their customers are who they claim to be. Be it traditional banking and insurance giants or new-age BNPL lenders; the Know Your Customer (KYC) process is key to onboarding any new customer.

Yet, KYC has for years remained a sore point for the BFSI industry. Literally everyone hates filling long & complex KYC forms. Since this form filling is perceived as a ‘chore’, customer experience tends to go for a toss, and onboarding new customers becomes a real hassle. This leads to higher drop rates and abandoned applications,

That’s where Conversational KYC comes in. Using the Tars WhatsApp Engagement Suite, users can conversationally complete the KYC process; uploading and sharing media like documents and images over a friendly, encrypted WhatsApp chat. For your BFSI business, this essentially translates to quicker and more KYC submissions: courtesy an engaging WhatsApp conversation that doesn’t overwhelm users with a million fields at the same time!

2. Smart Notifications

We all know the boring transactional messages that tend to pile up in our SMS or Email Inbox. They are cold, impersonal and serve little purpose other thank ticking a checkbox in customer communication. What if we told you that not only can these transactional messages be turned into engaging chat-based conversations — but they can also be triggered automatically, straight from your CRM!

That’s right, using the Tars WhatsApp Engagement Suite — your Banking & Financial Services business can automatically trigger a smart notifications every time a customer signs up for your services, containing information like ⤵️

All of this without the user ever leaving the chat! What’s key here is that Smart Notifications turn transactional communication into user engagement; thereby supercharging the customer experience.

3. Quick Information Retrieval

Your customers want to retrieve useful info — immediately, securely, and without any effort. But banking and finance websites require extensive navigation on the customer’s end to find what they are looking for. Often, existing clients want to know their account statement, or quickly find their nearest ATM. For L1 actions like these they neither want to open cluttered webpages overflowing with details; nor do they need human assistance. A bot connected to the CRM can easily retrieve such info. And that’s the customer experience we specialize in!

How would it work? For example: the Tars WhatsApp Engagement Suite can be configured such that it gives users a list of nearby ATMs based on keyword input, or retrieve account balance based on Unique IDs.

4. Personalized Customer Marketing

Customer marketing is a term that refers to any marketing activity that’s aimed at your current customers. While channels like Email & SMS have been traditionally used for customer marketing campaigns, they tend to have extremely low open-rates and non-existent response rates.

Where Emails & SMSes fail, WhatsApp shine. Using the Tars WhatsApp Engagement Suite – any bank or finance co. can drive more revenue from their existing customers by sending personalized offers, newsletters and product launches, straight into the customer’s WhatsApp inbox.

5. Immediate Customer Satisfaction

The banking sector runs on competing levels of customer trust. And trust requires speedy resolution of all queries, claims & support tickets, not once — but constantly. Since hiring an army of live agents is cost-ineffective, you can get all your commonly-asked customer support queries — about registered addresses, net banking passwords, recurring payments, etc. — answered automatically, 24×7, through the Tars WhatsApp Engagement Suite.

High-quality customer support can improve customer satisfaction which in turn can ensure customer loyalty.

Web Use-Cases For Chatbots in Banking & Financial Services

1. Lead Generation

At the heart of any banking or financial services operation is undoubtedly lead generation. What makes lead gen in these industries stand out is its intense focus on the following:

💎 quality of leads

💎 lead qualification

This special focus is a by-product of the kind of customers that a bank (or fintech) seeks to acquire. It’s especially true for those BFSI companies that tend to work in a specific niche: housing finance, mortgage brokers, student and instant lenders. It’s here that chatbots truly excel: by providing an engaging conversational interface to qualify leads through questions regarding age, tax, credit score etc.

The OCBC Bank is a great example of how to use a banking bot for customer acquisition. Its chatbot “Emma” has proved its worth in turning cold leads into pre-qualified leads with a total of USD$7,117,945.30 in loan applications within 3 months.

2. Digital Banking Chatbot

Finance is extremely personal because it involves customers parting with their hard earned money and trusting a third party, to do what’s in their best fiduciary interest. This requires a high level of consumer trust which cannot be bought but only earnt. Which begs the question — How?

There are two ways of earning this trust:

📤 being transparent regarding your products and services.

📥 being responsive when it comes to a customer’s queries.

While banks & other financial services have typically relied on human agents to provide quality financial advice to their customer base, in the age of online banking - not only do they cost a fortune, but they also make little financial sense when it comes to acquiring, nurturing and expanding in any segment barring high net worth accounts.

But does that means banks should suggest do away with the old adage “every customers matters”? Certainly not! Here’s where digital banking chatbots come in. Through a conversational interface that costs a fraction of an agent army, they can automate the following:

🙋🏼♂️ Retrieving Account Information: For example, in Capital One’s ‘Eno’ chatbot, clients can get information from the chatbot about account balance, transaction history, and credit limit as an instant message and can pay bills instantly.

🙋🏼♂️ Answering of FAQs: For example, HDFC Bank’s ‘Eva’ (Electronic Virtual Assistant) is an AI-powered chatbot that offers quick answers to customers related to FAQs, eligibility & interest rates, and payments. It has over 85% accuracy and holds over 20,000 conversations daily with customers from around the world.

🙋🏼♂️ Providing Financial Advice: For example, available within the Bank of America app, the virtual financial assistant ‘Erica’ is designed to help customers more easily manage their money. Within the interactive interface, Erica provides reward and account balances, spending summaries, refund confirmations and credit scores. She can also identify duplicate charges and send bill reminders.

3. Interactive Service / Product Discovery

From housing finance to mutual funds to credit cards, every bank/financial institution offers a whole host of services & products, for which it wants both maximum visibility and ease of user discovery. But this is easier said than done.

That’s where banking chatbots come in. Instead of trying to upsell you on a million things at the same time they presents users with a clean interface through list & button menus, where they can direct the product discovery process, and learn more about the same, without ever leaving an engaging chat.

4. Customer Care

At its core, banking is not simply about profit, but about long-term personal relationships. Building these relationships requires speedy resolution of all queries, claims & support tickets, not once — but constantly. Since hiring an army of live agents is cost-ineffective, you can get all your commonly-asked customer questions — about registered addresses, net banking passwords, recurring payments etc. — answered automatically, 24×7, through Banking Chatbots embedded in landing pages and web applications.

For example, Amy is an AI-powered chatbot solution for corporate banking at HSBC Bank (Hong Kong) that provides real-time responses to assist customers. Apart from helping customers access information regarding the bank’s products and services, the bot has the capability to process and analyze customer feedback to keep customers engaged.

FAQs

What are the 5 best chatbots in banking?

5 Best Chatbot Templates for Banking & Financial institutions are:

How To Get Started With Tars WhatsApp Engagement Suite?

For a lot of you this is the part of the guide you’ve been waiting for so let’s jump right in. There are two parts to getting started with Tars WhatsApp Engagement Suite:

✅Part A: Getting WhatsApp Business API Access

✅Part B: Building A Conversational Flow

It is important to note that these two parts do not have to occur in a particular order. In fact, we recommend that you get both started at the same time.

With that, here is a breakdown of each part 👇🏼

Part A: Getting WhatsApp Business API Access

Before you can even start thinking about creating your WhatsApp chatbot you need to get access to the WhatsApp Business API.

Step 1: Verify your Business on Facebook.

Since WhatsApp is owned by Facebook, they handle their business verification through Facebook’s business platform. You can find instructions on how to verify your business through Facebook.

Note: If your company runs Facebook ads you probably have this step complete

Step 2: Apply for WhatsApp Business API Access

Fill-out our WABA Submission Form, verify your phone number with OTP and generate an API token.

Step 3: Add WhatsApp Business Number

In the Admin Dashboard, under the campaign menu on your left, choose ‘Business Number’ and then fill in the necessary details like Company Name, API Key etc.

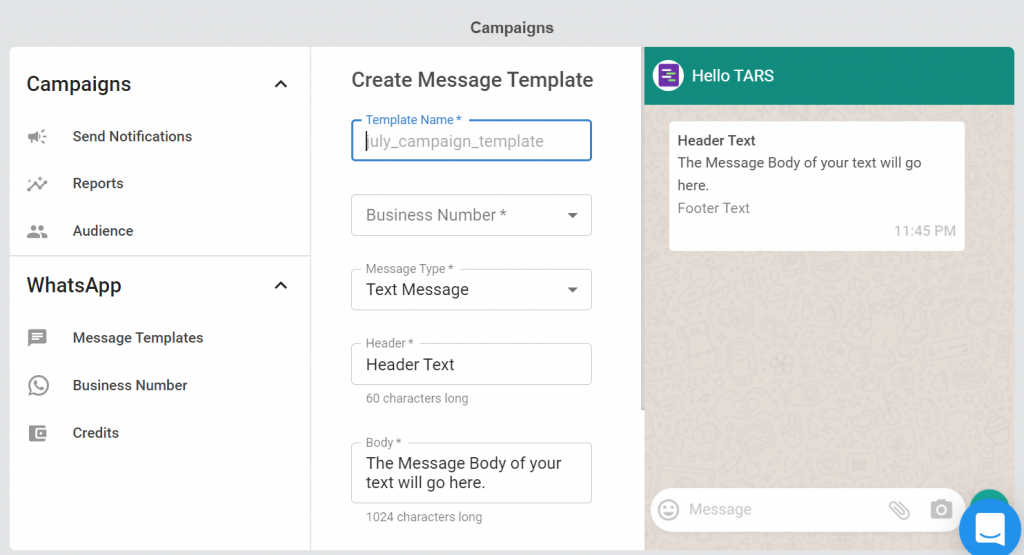

Step 4: Create Message Templates

Finally, depending on your use-case, create a message template for your first WhatsApp Campaign.

Part B: Building A Conversational Flow

Step 1: Signup for the TARS Chatbot Builder

The sign up process is super simple! All you have to do is go to https://admin.hellotars.com/, fill in a few details and signup for free!

Step 2: Create A New Chatbot

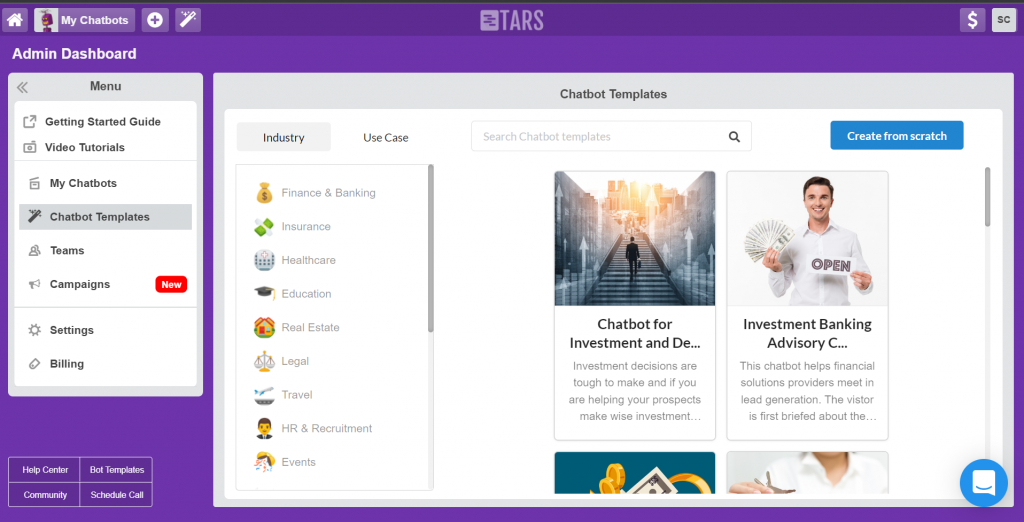

When you first signup for the TARS builder you will be dropped into our templates library:

You can use any of the 950+ templates that we have as a base for your chatbot, but in this guide, we are going to build one from scratch so click the Create From Scratch button on the top-right corner of the screen:

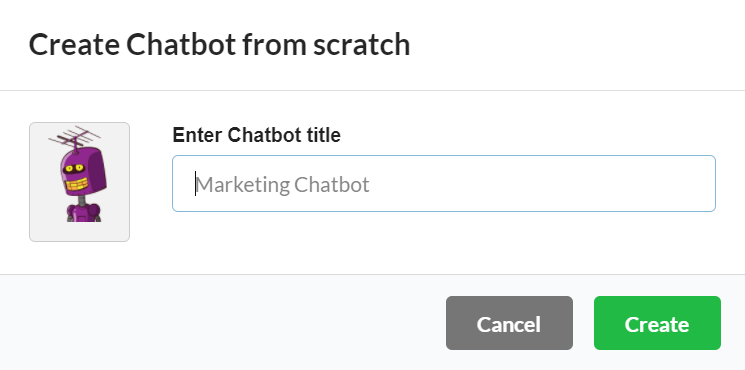

Next, it’s time to give your chatbot a cool name!

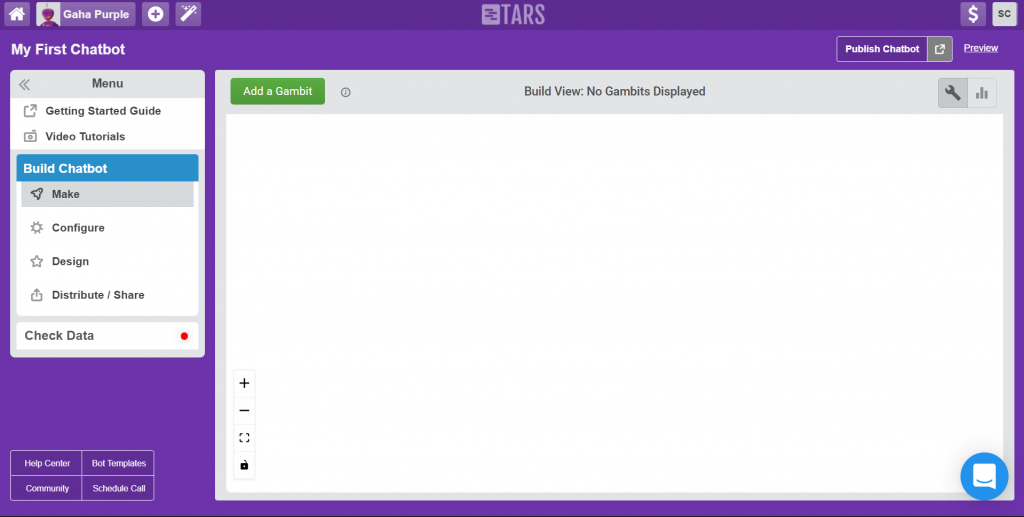

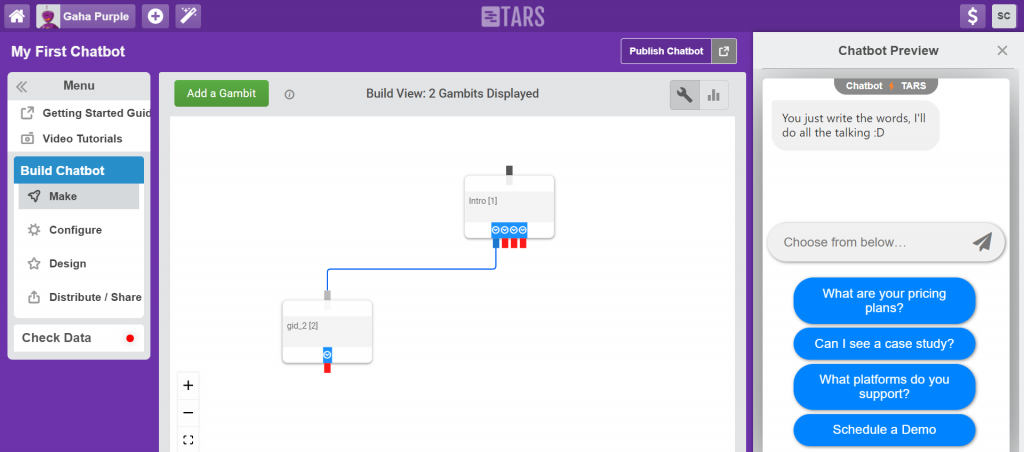

Once you hit ‘create’, you will be automatically taken to the ‘Make Section’:

Step 3: Create A Gambit

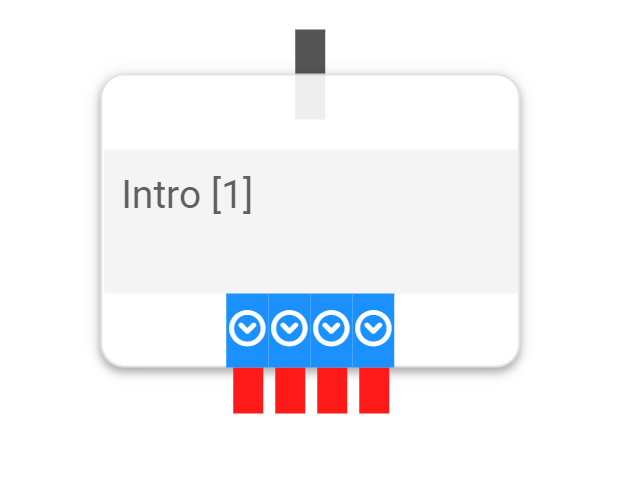

To start creating your conversational flow, click the green ‘Add a Gambit’ button on the top left of the screen. This will populate your canvas with a weird-looking object that looks like this:

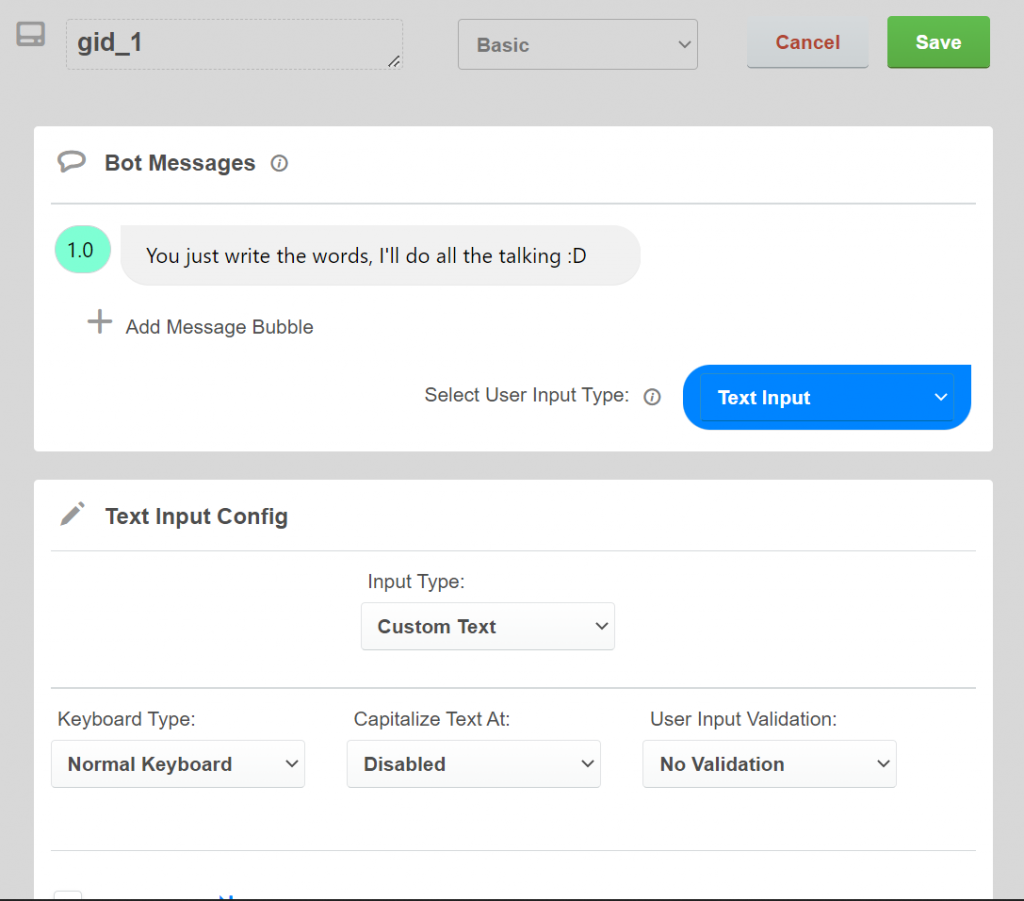

This object is called a Gambit, and it is the basic building block of any conversation. To understand how it works click on it to open up the Gambit Modal:

As you can see, each gambit is made up of two parts: Bot Messages and User Input. Using these two parts of the gambit modal you can define a single back-and-forth interaction between the bot and the user.

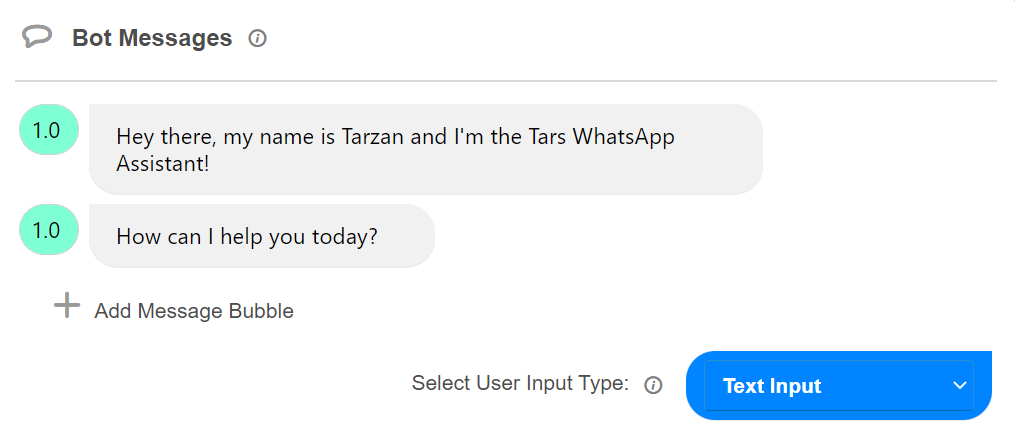

Since we’re still on the first gambit, go ahead and write the messages in such a way that they welcome the user to the chatbot:

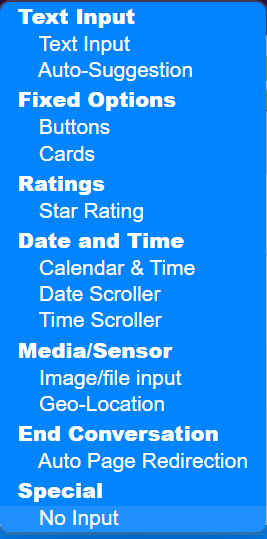

Once the messages are complete, you can specify how users can respond to these messages by clicking the Select User Input Type dropdown:

We have over a dozen user input options available in our builder, but for WhatsApp, only the text, button, image/file, geo-location, no input, and auto page redirection input UIs are compatible.

The most popular input UIs in the TARS builder are text and buttons, so we’ll focus on those in this guide

But before that? Enable WhatsApp Native UI:

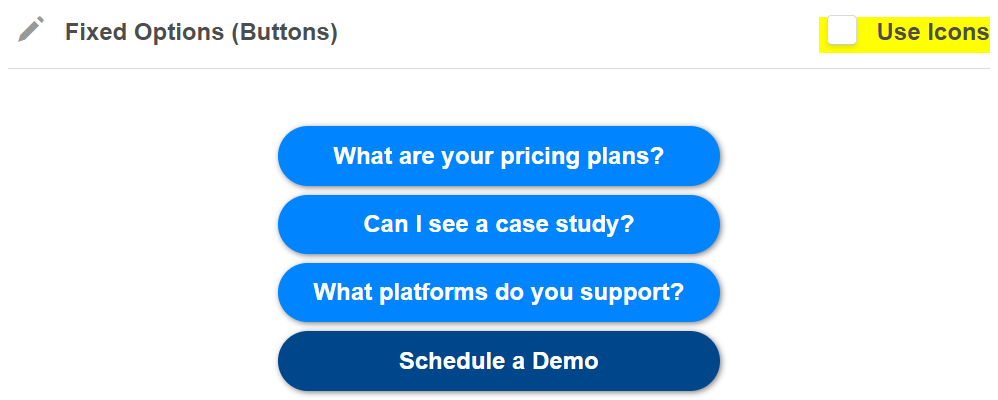

For the first gambit of the FAQ/Leadgen bot we are creating in this guide, select the Buttons option and type in all of the FAQs that you want the bot to answer in as buttons.

Since this is also going to be a lead gen chatbot, throw in an extra button for users to start the lead gen flow of the conversation. In this example, we’re going to let people schedule a free demo.

Once the buttons are set up, rename the Gambit something descriptive (in this case intro), and hit the Save button. The result ought to be something like this:

You will now notice that the Gambit now has four red sockets sticking out of the bottom. These sockets correspond to the button options we defined in the gambit. As you will see in the next step, they will allow you to branch the conversation off in different directions based on the user’s input

Step 4: Create a second Gambit and connect it to the first

Next, create a second gambit and connect it to the first gambit, by dragging one end to the other.

From here on, figuring out the rest of the conversational flow is pretty intuitive. For example: you should fill out the messages in the second gambit such that it responds to the corresponding question that we specified in the first gambit, and so on.

Step 5: Test Your Bot In Preview

Meticulously crafted your entire chatbot flow? Can’t wait to test the conversational masterpiece you just created? All you must do then is click on Preview.

And Voila! A preview window will immediately appear on the right side of your screen:

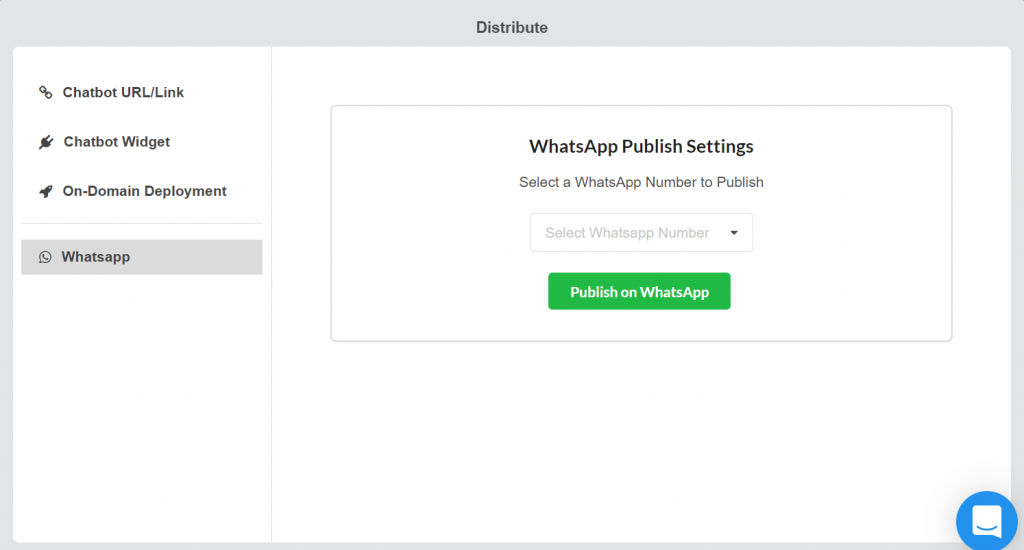

Step 6: Connect your bot to your WhatsApp Business API credentials (Ref: Part 1)

After you are done testing your conversational flow in Preview, click on the distribute section and select the WhatsApp number you want to connect your fresh new bot to. Lastly, hit ‘Publish on WhatsApp’.

Curious To Learn More About WhatsApp Engagement?

Book a demo with us today and one of our in-house WhatsApp Engagement Experts will personally walk you through the entire process!